We cover a wide range of property sectors and offer the best opportunities to our investors in both the commercial and residential markets.

What we cover

Residential development

We build and deliver high-end apartments of different types, from house conversions to land development and commercial conversion projects.

Co-living

Our strategy consists of creating high-standard self- contained studios with en-suite shower rooms and kitchenettes, as well as spacious communal areas.

Commercial

This sector includes a variety of use classes (restaurants, shops, offices) and includes straightforward investments as well as the development of existing or new premises.

Hotel & leisure

These ever-green sectors attract investor from all over the world and can represent a safe heaven for investors and developers, if located in the right place.

Where to Invest?

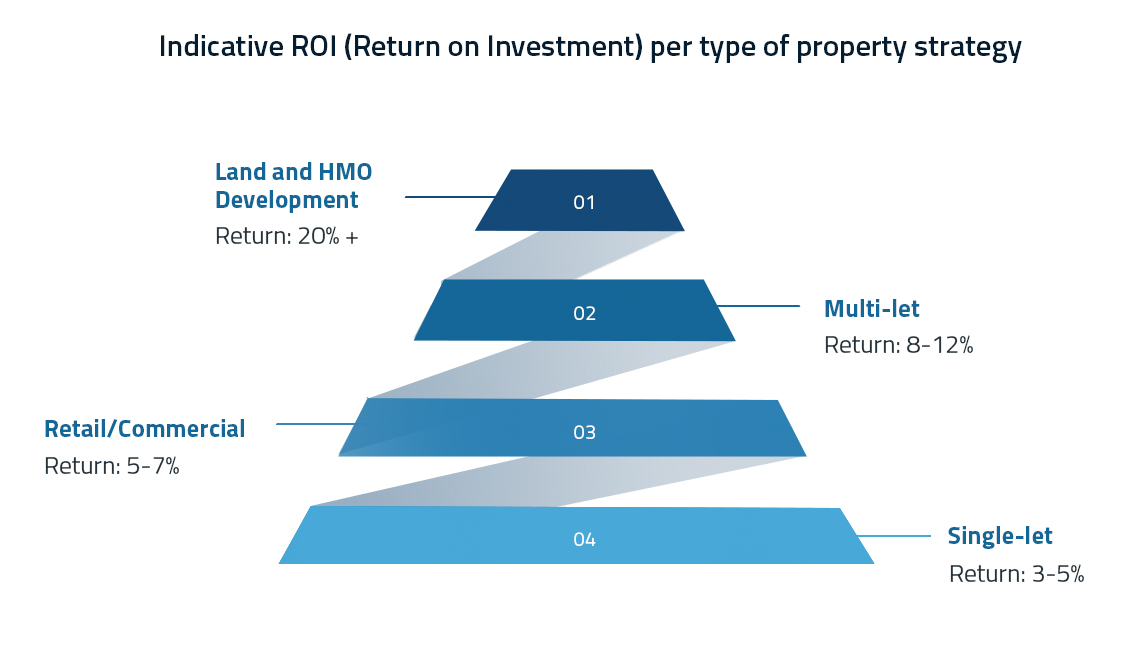

Depending on your strategy and budget, we advise on the most suitable sector to invest in, to maximise your returns and minimise the risk.

We cover a variety of property sectors, including residential and Co-living/HMO developments, commercial investments, and hotels & leisure. Each sector can be combined with a different strategy, such as buy-to-let, build-to-sell or build-to-rent, based on your expected targets. We advise you on the best-informed choice and on where short or long-term returns on investments (that vary from 3 to 20+ per cent) can be achieved.